In the ever-evolving landscape of finance, fintech companies have emerged as key players, revolutionizing traditional banking and financial services. In the United States, the hub of technological innovation, several fintech companies have made significant strides, reshaping how people manage their money, invest, and conduct transactions.

Introduction to Fintech Companies

Fintech, short for financial technology, refers to the integration of technology into financial services to make them more efficient, accessible, and affordable. Top Fintech Companies in USA have gained prominence due to their ability to disrupt traditional banking systems and offer innovative solutions to consumers and businesses alike.

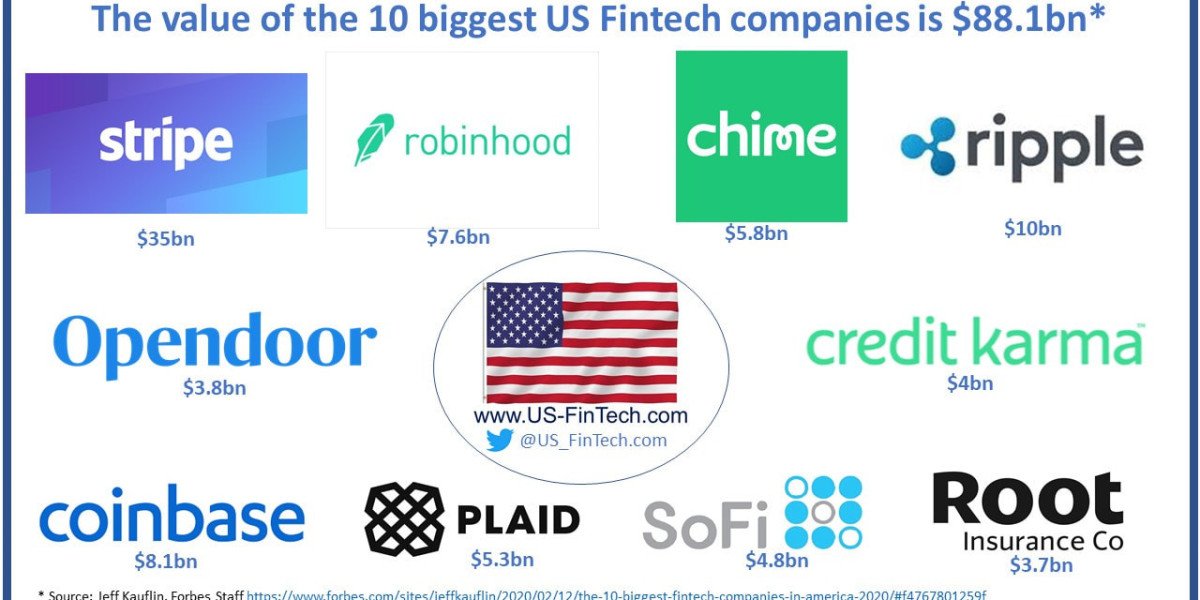

Overview of the Fintech Industry in the USA

The fintech industry in the USA has witnessed exponential growth in recent years, fueled by advancements in technology and changing consumer preferences. From mobile payment solutions to robo-advisors, the fintech sector encompasses a wide range of services catering to various financial needs.

Criteria for Top Fintech Companies

Determining the top fintech companies involves considering several factors, including innovation, market presence, and customer satisfaction. Companies that excel in these areas often lead the industry and drive significant change.

Top Fintech Companies in the USA

Stripe

Stripe is a payment processing platform that enables businesses to accept online payments seamlessly. Known for its user-friendly interface and extensive feature set, Stripe has become a go-to solution for e-commerce merchants worldwide.

Robinhood

Robinhood is a commission-free trading platform that has democratized investing, allowing individuals to buy and sell stocks, options, and cryptocurrencies without paying traditional brokerage fees. With its intuitive mobile app and innovative approach to investing, Robinhood has attracted millions of users.

Square

Square offers a suite of financial services, including payment processing, point-of-sale systems, and business loans. Catering to small businesses, Square has simplified the process of accepting payments and managing finances, empowering entrepreneurs to thrive.

PayPal

PayPal is a leading digital payments platform that facilitates online transactions between individuals and businesses. With its widespread acceptance and robust security features, PayPal has become synonymous with online payments, providing a convenient and secure way to send and receive money.

Coinbase

Coinbase is a cryptocurrency exchange platform that allows users to buy, sell, and store digital assets such as Bitcoin, Ethereum, and Litecoin. With its user-friendly interface and emphasis on security, Coinbase has played a pivotal role in mainstreaming cryptocurrencies.

Analysis of Each Top Fintech Company

Each of the top fintech companies offers unique services and has its own success stories and challenges. While they have disrupted traditional financial services, they also face regulatory scrutiny and competition from established players.

Future Trends in the Fintech Industry

Looking ahead, the fintech industry is poised for further innovation and growth. Technologies such as artificial intelligence, machine learning, and blockchain will continue to drive advancements, enabling fintech companies to expand into new markets and offer more personalized services.

Conclusion

In conclusion, the top fintech companies in the USA are transforming the way people manage their finances and interact with the financial system. With their innovative solutions and commitment to customer satisfaction, these companies are driving the future of finance and shaping the digital economy.